AI in Retail Banking

The era of the static banking app is ending and AI is changing the industry.

It has become fashionable to talk about the AI bubble being about to burst based on the trillions invested in compute, the performance ceiling on multi-trillion parameter LLMs, and the infamous MIT paper about 95% of AI Agents not working.

But away from the gaze of the hypers and the hype deflaters, there is a transformation going on across enterprises in every industry. Here we do a shallow dive into how AI Agents are being adopted in Retail Banking.

It is based on an AI workshop our founder Emanuela Vartolomei recently conducted with a group of professionals from a leading UK retail bank.

From “Chatting” to “Doing”

The era of the static banking app is ending. For years, “digital transformation” in banking meant moving paper forms to website pages and deploying basic chatbots to answer FAQs. But the data shows that this is not enough. Only 29% of customers report they are “very satisfied” with bank chatbots. The industry is ripe for a revolution.

The next wave of innovation is about AI that can execute a bank transfer, negotiate a bill, or plan a mortgage. This is the difference between a chatbot and an AI Agent.

Everyday Banking: Streamlining the Mundane

In core banking functions, AI agents are transforming routine interactions into seamless experiences.

In-App Banking Co-Pilot: Acts as a virtual guide within mobile apps, pre-filling forms, routing queries, and executing transactions via chat or voice.

Dispute Handling Agent: Automatically investigates and resolves disputes, reducing manual intervention.

Agentic Payment Assistant: Schedules and executes bill payments, queries transactions, and provides daily banking support.

Spending Intelligence Agent: Analyzes spending patterns to offer proactive insights.

Virtual Assistant at Scale: Handles everything from transaction completions to personalized advice.

Key Capabilities: These agents enable complete transactions through natural language, auto-route queries, and boost app engagement. For banks, the ROI is compelling, lower cost per interaction, reduced operational handling times, higher account stickiness, and even absorbing costs from live customer service reps. Fraud prevention agents, for instance, block suspicious transactions in real-time, directly slashing fraud losses.

Cash Management: Indispensable Financial Coaches

As challenger banks and like Monzo and Revolut hoover up new deposits, AI enablement is now table stakes when it comes to smart tools that help retain retail customers.

Budgeting Assistants monitor accounts and provide personalized coaching on spending habits, leading to lower delinquency rates and higher account retention.

Overdraft Fee Avoidance Agents proactively alert customers and suggest actions to prevent costly fees, reducing fee-related complaints and potential regulatory investigations.

Bill Negotiation Agents work on behalf of customers to secure better rates on recurring services, increasing customer loyalty and account stickiness.

Subscription Detection Agents identify unused subscriptions and suggest cancellations, reducing unnecessary card disputes.

Savings Goal Planning Agents automatically transfer funds to higher-yield savings accounts, helping customers optimize their returns.

Capabilities and ROI: From pre-filling info for queries to executing payments and cancellations, these tools lower delinquency rates, reduce fee-related complaints (and potential regulatory scrutiny), and increase retention. Card disputes drop, and customers stick around longer, fostering deeper relationships.

The lending landscape is being transformed

For decades, banks have typically fought the battle in the highly competitive mortgage market using the same two weapons: interest rate pricing, and innovate mortgage products. With AI they can and will have to bring in some new customer-focused weapons if they are going to retain market share.

Mortgage and Loan Scenario Planning Agents that provide real-time affordability analysis, leading to higher application completion rates.

Debt Management Coaches that create personalized paydown plans and messaging, resulting in lower delinquency rates.

Repayment Plan Negotiation Agents that automate repayment programs, significantly reducing collection costs.

The result is higher application completion rates, lower delinquency, and reduced collection costs make lending more efficient and customer-friendly.

In Wealth Management services, AI is bringing sophisticated tools

AI can process vast amounts of information which was previously unimaginable for a wealth advisor.

Investment Assistant: Monitors portfolios, executes trades, and summarizes risks.

Investment Research Agent: Compiles research and prompts portfolio adjustments.

Pensions Planning Agent: Simplifies retirement planning with personalized projections.

ROI for Banks: Banks see increased trading revenue, upsell opportunities to managed portfolios, and greater uptake of wealth products.

Challenges in AI Adoption

Despite the compelling case for AI, significant barriers remain:

Limited AI Expertise. Only 19% of banks are guided by highly specialized AI teams

Model Accuracy Concerns. Executives worry about inaccurate and inconsistent outputs

Data Quality Issues. 72% express concerns about data quality for fine-tuning models

Energy and Sustainability Conflicts. 70% struggle to reconcile AI energy usage with climate goals

Rapidly Changing Landscape. 57% feel overwhelmed by constant new developments

Data & Sourcing

The data used above came from multiple sources, including Accenture EY, McKinsey, BCG, KPMG, and internal industry research (2023-2025).

Conclusion

The transition from static interfaces to autonomous agents represents a fundamental shift in how banks serve their customers. While the opportunities for cost reduction and deeper engagement are clear, the technical and operational hurdles described above often stall progress.

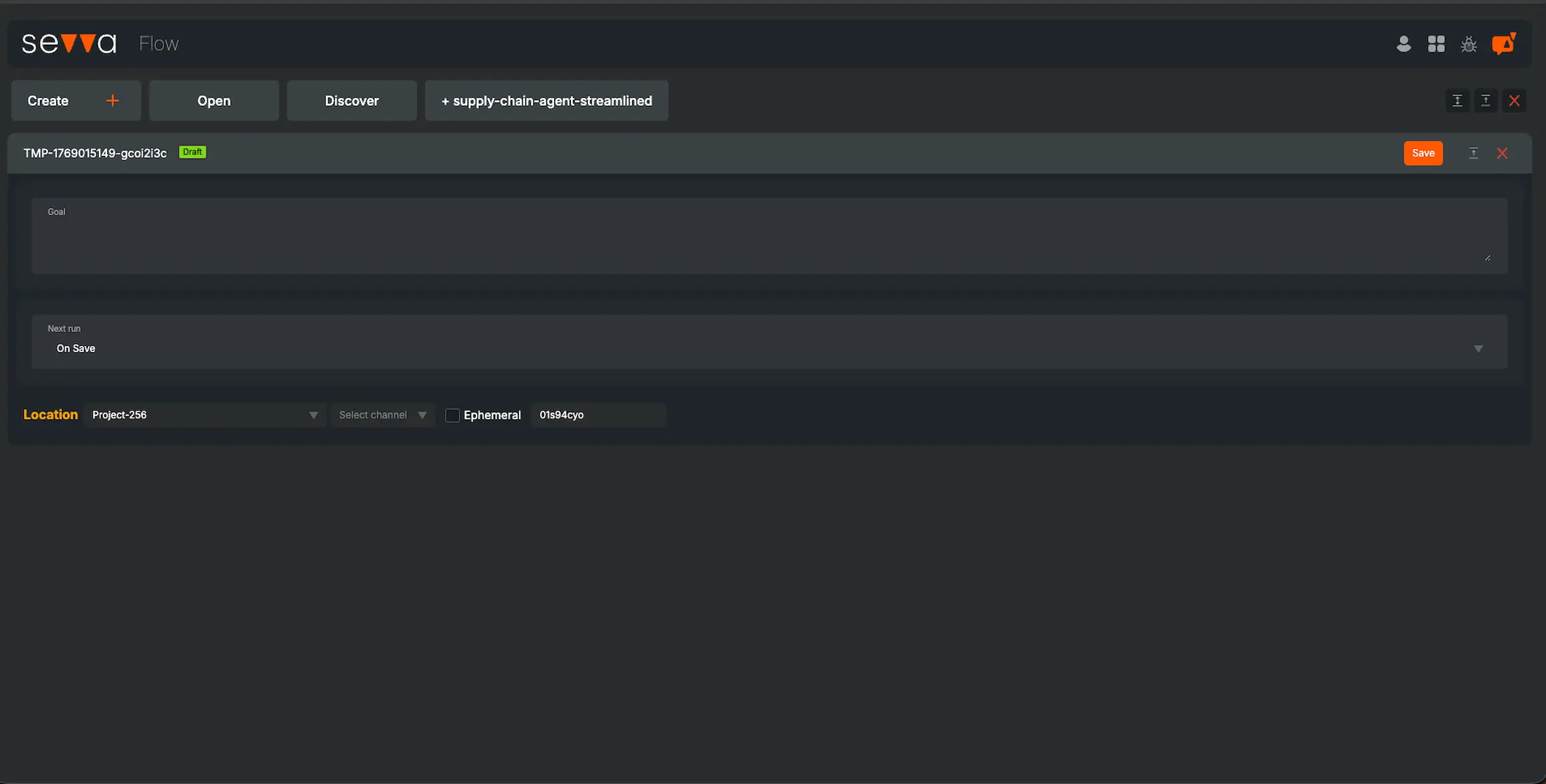

Sevva AI bridges this gap. We provide the infrastructure to build, orchestrate, and deploy agents that are accurate, secure, and compliant by design. You can now overcome the limitations of data quality and internal expertise to deliver the practical, action-oriented experiences your customers expect. By focusing on execution rather than just conversation, you can turn these challenges into a competitive advantage.

Related Posts

To get a taste of how AI enables the retail bank of the future take a look here The Agentic Bank.

To get a deeper understanding of the margin compression trends that will force retail banks to adopt AI go here The Bank Profit Squeeze.